5-1 How can you add a cash flow in year two and a cash flow in year four in year seven?

To add cash flows, they need to be moved to the same time period. The cash flows in years two and four should be moved forward with interest to year seven, then they can be added together.

5-2 People can become millionaires in their retirement years quite easily if they start saving early in employer 401(k) or 403(b) programs (or even if their employers don’t offer such programs). Demonstrate the growth of a $250 monthly contribution for 40 years earning 9 percent APR.

Using equation 5-2, we have:

5-3 When you discount multiple cash flows, how does the future period that a cash flow is paid affect its present value and its contribution to the value of all the cash flows?

Discounting reduces a future cash flow to a smaller present value. Cash flows far into the future become very small when discounted to the present. Thus, cash flows in distant future periods have small impacts on present values.

5-4 How can you use the present value of an annuity concept to determine the price of a house you can afford?

Mortgages are typically for a large enough amount of money that borrowing is required to purchase a home. The amount that one can afford for a home is a function of their current state of wealth. Mortgages allow consumers to spread the expense of a home over a longer period, typically 15 or 30 years. This allows consumers to put a smaller portion of wealth into the home (for example, a 20% down payment) and borrow the balance over the life of the loan. Due to the effect of annuity compounding, the payments for such a long lived debt make the monthly payments of a manageable nature so that they can be paid from current income.

5-5 Since perpetuity payments continue for ever, how can a present value be computed? Why isn’t the present value infinite?

Equation 5-5 is used to calculate the present value of a perpetuity. It is a limiting version of equation 5-

5-6 Explain why you use the same adjustment factor, (1 + i), when you adjust annuity due payments for both future value and present value.

Adjusting an annuity due calculation involves shifting the entire series of payments forward one period. This is accomplished by multiplying by (1 + i) irrespective of whether it is a future value or present value calculation.

5-7 Use the idea of compound interest to explain why EAR is larger than APR.

The annual percentage rate does not take into account the frequency of interest compounding. Equation 5-8 illustrates the conversion from

5-8 Would you rather pay $10,000 for a five year $2,500 annuity or a ten-year $1,250 annuity? Why?

The effective annual rates for these two payment streams are 7.93% and 4.28% respectively. I would rather pay $10,000 for a five year $2,500 annuity as it earns a higher effective annual rate of interest.

5-9 The interest on your home mortgage is tax deductible. Why are the early years of the mortgage more helpful in reducing taxes than in the later years?

Mortgage payments at the beginning of the amortization schedule are predominantly interest with little principal. In later years, interest payments decline and principal payments make up an ever increasing part of the payments. Thus, the tax deductible part (the interest payment) is larger in the beginning years.

5-10 How can you use the concepts illustrated in computing the number of payments in an annuity to figure how to pay off a credit card balance? How does the magnitude of the payment impact the number of months?

Utilizing equation 5-2, you can declare the present balance for the credit card and set that equal to the

Problems

5-1 Future Value Compute the future value in year 8 of a $1,000 deposit in year 1 and another $1,500 deposit at the end of year 3 using a 10% interest rate.

Use equation 5-1:

FV = $1,000 × (1 + 0.10)7 + $1,500× (1 + 0.10)5 = $1,948.72 + $2,415.77 = $4,364.48

5-2 Future Value Compute the future value in year 7 of a $2,000 deposit in year 1 and another $2,500 deposit at the end of year 4 using a 8% interest rate.

Use equation 5-1:

FV = $2,000 × (1 + 0.08)6 + $2,500 × (1 + 0.08)3 = $3,173.75 + $3,149.28 = $6,323.03

5-3 Future Value of an Annuity What is the future value of a $500 annuity payment over 5 years if interest rates are 9 percent?

Use equation 5-2:

5-4 Future Value of an Annuity What is the future value of a $700 annuity payment over 4 years if interest rates are 10 percent?

Use equation 5-2:

5-5 Present Value Compute the present value of a $1,000 deposit in year 1 and another $1,500 deposit at the end of year 3 if interest rates are 10 percent.

Use equation 5-3:

5-6 Present Value Compute the present value of a $2,000 deposit in year 1 and another $2,500 deposit at the end of year 4 using an 8% interest rate.

Use equation 5-3:

PV = $2,000 ÷ (1 + 0.08)1 + $2,500 ÷ (1 + 0.08)4 = $1,851.85 + $1,837.57 = $3,689.43

5-7 Present Value of an Annuity What’s the present value of a $500 annuity payment over 5 years if interest rates are 9 percent?

Use equation 5-4:

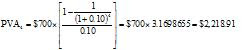

5-8 Present Value of an Annuity What’s the present value of a $700 annuity payment over 4 years if interest rates are 10 percent?

Use equation 5-4:

5-9 Present Value of a Perpetuity What’s the present value, when interest rates are 7.5 percent, of a $50 payment made every year forever?

Use equation 5-5:

5-10 Present Value of a Perpetuity What’s the present value, when interest rates are 8.5 percent, of a $75 payment made every year forever?

Use equation 5-5:

Nice work this blog gives clear knowledge about investment. stockinvestor.in is a stock related website which provides all stock market information.

ReplyDeleteSensex

buy and sell

shares

stock exchanges